INTRODUCTION TO THE INDIAN STOCK MARKET

Did you know India’s stock market is one of the oldest in Asia, dating back to 1875, and today ranks among the top five globally by market capitalization? Whether you’re sipping chai dreaming of financial freedom or just curious about how people make money from stocks, you’re in the right place. The Indian stock market is a vibrant ecosystem where millions buy and sell shares, driving economic growth and creating wealth. In this blog, we’ll break down the basics: the key exchanges (BSE and NSE), the major indices (Sensex and Nifty 50), and how you—yes, you—can start investing. By the end, you’ll have a solid foundation to kick off your financial journey. Let’s dive in!

What Is the Indian Stock Market?

The Indian stock market is a marketplace where shares of publicly listed companies are traded. Companies sell shares to raise money for growth—think Reliance building new factories or Infosys expanding its tech empire—while investors like us buy those shares hoping their value rises. It’s a win-win when done right.

The story begins with the Bombay Stock Exchange (BSE), founded in 1875 under a banyan tree in Mumbai. It’s Asia’s oldest stock exchange and a symbol of India’s financial legacy. Fast forward to 1992, and the National Stock Exchange (NSE) arrived, bringing electronic trading and revolutionizing how we invest. Today, BSE boasts a market cap of around ₹400 lakh crore (~$4.8 trillion USD), with more than 5,000 companies listed. NSE, meanwhile, handles over 90% of India’s equity trading volume with around 2,000 companies. Together, they’re the heartbeat of India’s economy, reflecting growth in IT, banking, manufacturing, and more.

Key takeaway: The stock market isn’t just for the Ambanis or Tatas—it’s a tool for anyone to grow their money over time.

The Big Players: BSE and NSE

Let’s meet the two giants running the show.

- Bombay Stock Exchange (BSE):

Located at Dalal Street, Mumbai, BSE is steeped in tradition. It’s home to the Sensex, a 30-stock index featuring blue-chip companies like Reliance Industries, TCS, and HDFC Bank. Trading happens from 9:15 AM to 3:30 PM IST, Monday to Friday. BSE is massive but less liquid than its younger sibling. - National Stock Exchange (NSE):

Launched in 1992, NSE embraced technology early, making it India’s go-to exchange. Its flagship index, the Nifty 50, tracks 50 top companies across 13 sectors—think Infosys, ICICI Bank, and Tata Motors. NSE dominates derivatives trading (more on that in coming weeks!) and is known for speed and accessibility.

While BSE has more listed companies, NSE’s higher trading volume makes it a favorite for most investors. Both are tightly regulated by SEBI (Securities and Exchange Board of India) to keep things fair. Fun fact: BSE still rings a ceremonial bell for new listings, while NSE’s sleek digital system reflects India’s modern financial leap.

Practical tip: Newbies often start with NSE due to its user-friendly platforms and liquidity.

Key Indices: Sensex and Nifty 50

Think of Sensex and Nifty as the stock market’s thermometers—they measure its health, not every stock’s pulse.

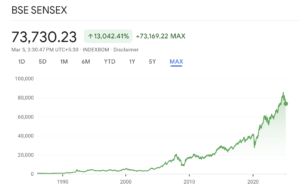

- Sensex:

Short for S&P BSE Sensex, it tracks 30 financially strong companies on BSE. It’s weighted by free-float market cap—big players like Reliance have more sway than smaller firms. If Sensex jumps from 80,000 to 81,000, it signals investor confidence, though not every stock may rise. - Nifty 50:

NSE’s star index covers 50 companies, representing ~65% of its market cap. It spans giants like Infosys and diverse sectors like pharma and auto. Nifty’s a benchmark for mutual funds and futures trading (we’ll unpack that later).These indices show trends, not guarantees. A 1% Nifty rise doesn’t mean all 50 stocks soared—some may have tanked while others spiked.

Key takeaway: Use Sensex and Nifty to gauge the market’s mood, not to pick your next stock.

How to Start Investing in India

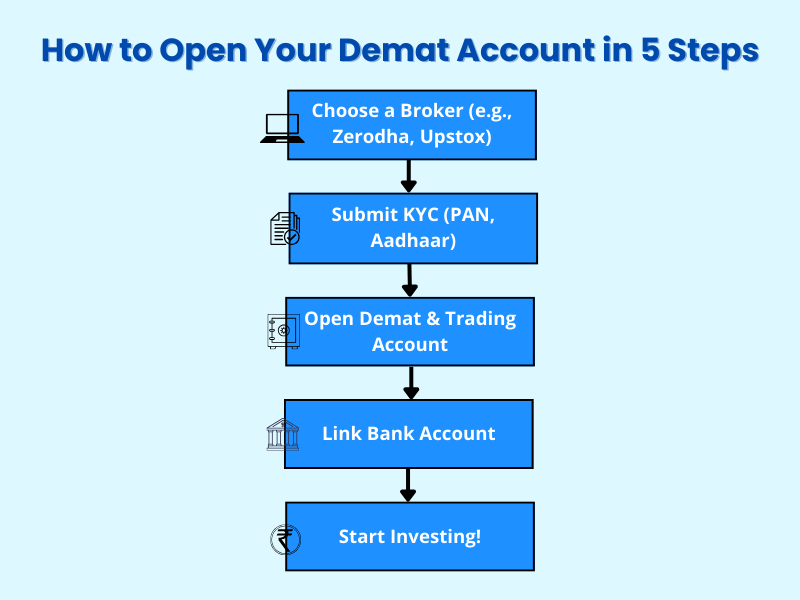

Ready to jump in? Here’s your step-by-step guide:

- Open a Demat Account:

A Demat (dematerialized) account holds your shares digitally, like a bank account for stocks. Providers like Zerodha, Upstox, Groww, Angel One, etc offer them—some for free, others for ₹200–500. You’ll need your PAN card and Aadhaar for KYC. - Link a Trading Account:

This connects your Demat to the exchange for buying and selling. It’s usually bundled with your Demat account. Link your bank account to transfer funds. - Choose a Broker:

- Discount brokers (e.g., Zerodha): Low fees (₹20/trade), DIY platforms—perfect for beginners.

- Full-service brokers (e.g., ICICI Direct): Higher fees, expert advice—better for hands-off investors.

- Start Small:

Buy your first stock—say, ₹1,000 worth of ABC Ltd. Download your broker’s app (like Zerodha Kite) to track prices live. SEBI ensures brokers play by the rules, so your money’s safe if you stick to legit platforms.

Practical tip: Begin with ₹5,000–10,000 to learn the ropes without sweating too much.

Why Invest in the Indian Stock Market?

Still wondering if it’s worth it? Here’s why:

- Wealth creation: Over 20 years, Nifty’s averaged ~12% annual returns. A ₹10,000 monthly SIP in a Nifty index fund since 2010 could be worth over ₹50,00,000 by 2025 (assuming 12% CAGR).

- Economic growth: India’s GDP is projected to grow 6–7% in 2025, boosting stocks in sectors like renewable energy and AI tech.

- Accessibility: Apps like Groww and Upstox have made investing as easy as ordering biryani online.

Of course, there are risks—volatility, scams—but education (like this blog!) helps you navigate them. The market rewards patience and smarts.

Call to action: Start small, stay consistent—your future self will thank you.

Conclusion

The Indian stock market, powered by BSE and NSE, is your gateway to financial growth. Sensex and Nifty light the way, and getting started is as simple as opening a Demat account with a trusted broker. Next week, we’ll dive deeper into what stocks really are and how they work—don’t miss it! For now, tell me in the comments: What’s stopping you from investing? Let’s chat!

Click here to follow me on Telegram and X (twitter)