OPTIONS TRADING 101: CALLS AND PUTS

Ever heard of options trading and thought it sounds like a game of chess in a Bollywood blockbuster?

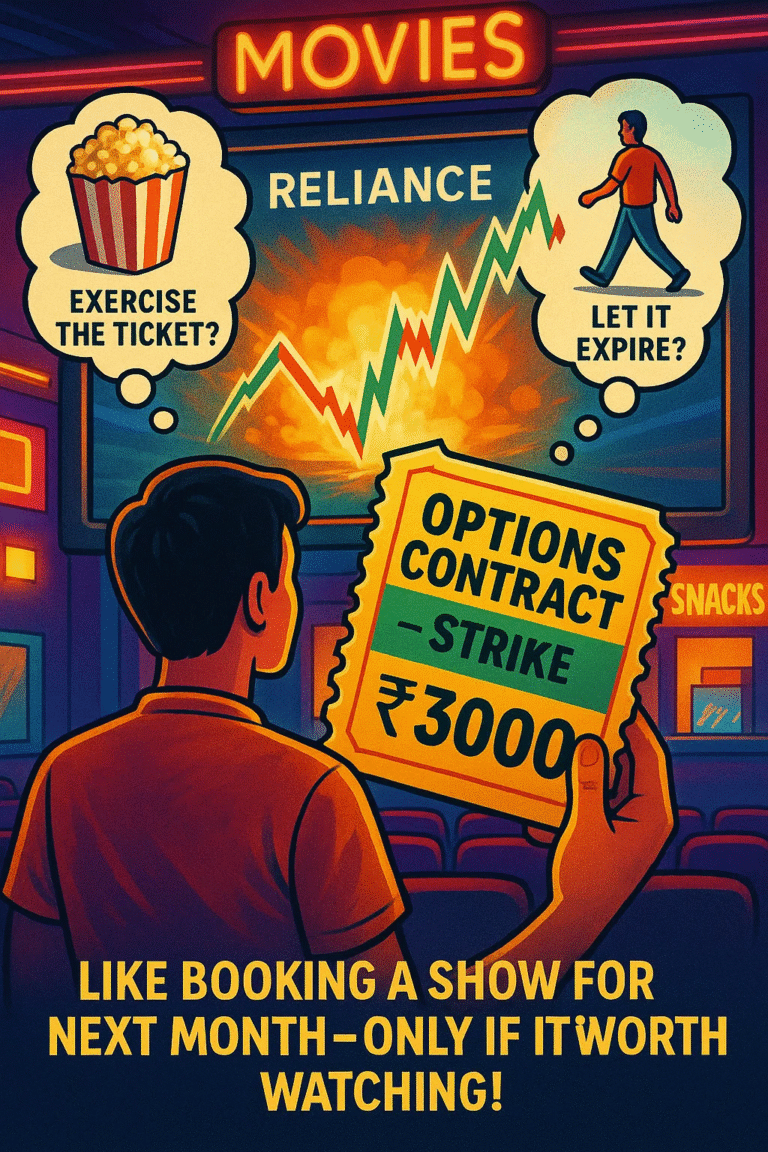

1. What Are Options Contracts? The Movie Ticket Bet

An options contract is an agreement that gives you the right, but not the obligation, to buy or sell an asset (like a stock or index) at a set price (strike price) by a specific date (expiry). Think of it as buying a movie ticket for a future show—you can choose to go (exercise the option) or skip it (let it expire).

- Key Terms:

- Underlying Asset: The stock or index (e.g., Reliance or Nifty 50) the option is based on.

- Strike Price: The fixed price at which you can buy/sell the asset.

- Premium: The cost of the option, like paying ₹100 for that movie ticket.

- Expiry: The deadline (usually the last Thursday of the month in India).

- Why It’s Cool: Options let you profit from price moves with less money than buying stocks. Plus, you can limit losses to the premium paid—unlike futures, which can be a rollercoaster!

- NSE’s F&O Segment: India’s options hub, where you trade contracts on stocks like HDFC Bank or indices like Nifty.

Fun Challenge: Imagine buying an option to purchase Reliance shares at ₹3,000 next month. Would you want the price to rise or fall? Drop your guess in the comments!

LOL Moment: Options are like reserving a spot at a buffet—you pay a small fee, but you don’t have to eat if the food looks meh!

2. Calls vs. Puts: The Yin and Yang of Options

Options come in two flavors: call options and put options. They’re like choosing between cheering for the hero (bullish) or the villain (bearish) in a market drama.

- Call Options:

- What Is It?: Gives you the right to buy the underlying asset at the strike price before expiry.

- When to Use: You’re bullish—think the price will rise. It’s like betting your favorite cricket team will score big.

- Example: Buy a Reliance call option with a ₹3,000 strike price for a ₹50 premium. If Reliance jumps to ₹3,200, you can buy at ₹3,000 and sell at ₹3,200, pocketing the difference (minus premium).

- Put Options:

- What Is It?: Gives you the right to sell the underlying asset at the strike price before expiry.

- When to Use: You’re bearish—think the price will fall. It’s like betting the other team will fumble.

- Example: Buy a Reliance put option with a ₹3,000 strike price for a ₹50 premium. If Reliance drops to ₹2,800, you can sell at ₹3,000, making a profit (minus premium).

- Key Difference: Calls = betting on price up. Puts = betting on price down. You pay a premium for both, but losses are capped at that premium.

Interactive Tip: Check NSE’s website (nseindia.com) for the “F&O” section. Can you find a call and put option for HDFC Bank? Share the premiums below! #OptionsHunt

Trader’s LOL Moment: Ever bought a call option thinking you’re a market genius, only for the stock to nap like it’s on vacation?

3. Real-World Example

Let’s make it real with Reliance Industries options, a favorite in India’s F&O segment. Assume Reliance is trading at ₹3,000, and you’re trading options with a lot size of 250 shares.

- Scenario 1: Call Option (Bullish)

- Setup: You think Reliance will hit ₹3,200 by expiry. You buy a call option with a ₹3,000 strike price for a ₹50 premium (total cost = ₹50 × 250 = ₹12,500).

- Outcome:

- If Reliance hits ₹3,200: Your option is “in-the-money.” You buy at ₹3,000, sell at ₹3,200, making (₹3,200 – ₹3,000 – ₹50) × 250 = ₹37,500 profit.

- If Reliance stays at ₹3,000 or below: Your option expires worthless. Loss = ₹12,500 (premium). No extra bill!

- Why It’s Exciting: Big profit potential for a small upfront cost.

- Scenario 2: Put Option (Bearish)

- Setup: You predict Reliance will drop to ₹2,800. You buy a put option with a ₹3,000 strike price for a ₹40 premium (total cost = ₹40 × 250 = ₹10,000).

- Outcome:

- If Reliance drops to ₹2,800: Your option is in-the-money. You sell at ₹3,000, buy at ₹2,800, making (₹3,000 – ₹2,800 – ₹40) × 250 = ₹40,000 profit.

- If Reliance stays at ₹3,000 or above: Your option expires worthless. Loss = ₹10,000 (premium).

- Why It’s Cool: Profit even when the market tanks, with limited risk.

- Key Note: Options are high-risk. Premiums are your max loss, but you need market knowledge to pick the right strike and expiry.

Quick Challenge: If Reliance is at ₹3,000 and you buy a ₹3,100 call option for ₹30 premium (250 shares), what’s your profit/loss if it hits ₹3,150? Calculate and share! #OptionsNinjaLOL Moment: Options trading is like playing Uno—pick the right card (call or put), but the market might still throw a wild card!

4. Risks and Rewards of Options Trading

Options are like spicy chaat—tasty but can burn if you’re not careful. Here’s the scoop:

- Rewards:

- Limited Loss: Your max loss is the premium paid. No surprise bills like futures!

- High Returns: Small price moves can mean big profits due to leverage.

- Flexibility: Profit in rising (calls) or falling (puts) markets, or use strategies like straddles for big moves.

- Liquidity: NSE options like Nifty and Reliance are super liquid, with tons of traders.

- Risks:

- Time Decay: Options lose value as expiry nears, like milk going sour.

- Volatility: Prices swing fast, and wrong bets mean losing your premium.

- Complexity: Picking the right strike and expiry takes skill. Not a “set it and forget it” game.

- Brokerage Fees: Premiums are small, but fees add up. Check with your broker!

- Time Decay: Options lose value as expiry nears, like milk going sour.

Interactive Tip: Watch an options video on Zerodha Varsity. What’s one risk you learned about? Drop it in the comments!Trader’s LOL Moment: Ever bought an option and watched it expire worthless, like buying a concert ticket and forgetting the date?

5. Getting Started: Tools & Platforms

No need to trade options with a calculator and a prayer—modern platforms make it easy. Here’s how to start:

- Zerodha Kite: India’s go-to platform for F&O trading. Check the “Options” tab for Reliance or Nifty contracts, with real-time charts and margin calculators.

- Upstox: Beginner-friendly app with F&O trading and market data. Great for quick trades.

- TradingView: Perfect for analyzing options charts with indicators like Bollinger Bands or RSI. Use paper trading to practice.

- NSE Website: Find contract details, strike prices, and premiums at nseindia.com.

How to Start:

- Open a trading account with Zerodha or Upstox (KYC required).

- Activate F&O trading (needs income proof due to high risk).

- Practice on TradingView’s paper trading or Zerodha’s demo mode.

- Start with 1 lot and use stop-losses to cap losses.

- Learn from Zerodha Varsity’s free options modules or Moneycontrol for market news.

Fun Challenge: Open Zerodha Kite, find a Reliance call option, and screenshot the premium. Share it with #OptionsFiesta!

LOL Moment: Setting up an options trade feels like prepping for a space launch—charts, premiums, and a hope the market doesn’t troll you!

6. Practical Tips for Novice Traders

- Start Small: Trade 1 lot to learn the ropes. Don’t go all-in like it’s a casino bet!

- Use Stop-Losses: Set exit points to limit losses. It’s like an emergency brake for your trades.

- Learn the Greeks: Understand “delta” and “theta” to gauge option price moves. Sounds nerdy, but super useful!

- Track Volatility: High volatility = pricier premiums. Check NSE’s India VIX for market mood.

- Practice First: Use TradingView’s paper trading to avoid real-money oopsies.

- Stay Disciplined: Options are tempting, but don’t overtrade. Your wallet isn’t a buffet!

Final Challenge: Analyze a Reliance options chart on TradingView. Spot a call or put opportunity? Share your idea with #OptionsStar!

7. Conclusion: Your Options Adventure Awaits!

Options trading is like a masala dosa—spicy, exciting, and packed with flavor. With calls and puts, you can bet on Indian stocks like Reliance or indices like Nifty, all with limited risk and big potential. NSE’s F&O segment, paired with platforms like Zerodha Kite and TradingView, makes it accessible for beginners. Start small, practice smart, and don’t let time decay catch you off guard. Got an options question or a funny trading moment? Drop it in the comments, and let’s keep the market party going! Happy trading, and may your premiums always pay off!