HOW TO ANALYZE A COMPANY BEFORE INVESTING

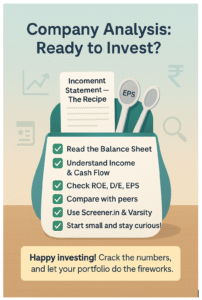

Don’t worry, analyzing a company isn’t rocket science—it’s like checking the health of a business before betting your money on it! By using fundamental analysis, you can dig into a company’s financials to see if it’s a superstar or a dud. In this blog, we’ll break down how to read a balance sheet, income statement, cash flow, and key ratios like ROE, Debt-to-Equity, and EPS, with a fun example using Reliance Industries. With a sprinkle of humor and interactive challenges, let’s make company analysis as exciting as binge-watching your favorite show!

Don’t worry, analyzing a company isn’t rocket science—it’s like checking the health of a business before betting your money on it! By using fundamental analysis, you can dig into a company’s financials to see if it’s a superstar or a dud. In this blog, we’ll break down how to read a balance sheet, income statement, cash flow, and key ratios like ROE, Debt-to-Equity, and EPS, with a fun example using Reliance Industries. With a sprinkle of humor and interactive challenges, let’s make company analysis as exciting as binge-watching your favorite show!

1. What Is Fundamental Analysis? The Company Health Check

Fundamental analysis is like giving a company a full-body checkup to see if it’s worth your investment. Instead of guessing based on stock price wiggles, you dive into its financial reports to understand its strength, profitability, and growth potential.

- Why It Matters: It helps you pick solid companies that’ll grow your money over time, not just ride market hype.

- Key Tools: Three financial statements (balance sheet, income statement, cash flow) and ratios like ROE, Debt-to-Equity, and EPS.

- Where to Start: Companies like Reliance or TCS publish these reports on their websites or platforms like BSE/NSE.

LOL Moment: Analyzing a company is like swiping right on a stock—check its “profile” before committing!

2. Balance Sheet: The Company’s Financial Snapshot

The balance sheet is like a company’s Instagram profile—it shows what it owns, owes, and what’s left for shareholders at a specific moment.

- Key Parts:

- Assets: What the company owns (cash, factories, investments). Think of it as its “bling.”

- Liabilities: What it owes (loans, bills). Like credit card debt, but for businesses.

- Equity: What’s left for shareholders (Assets – Liabilities). This is the company’s “net worth.”

- What to Look For:

- Strong assets (e.g., lots of cash or property).

- Manageable liabilities (not drowning in debt).

- Growing equity over time = healthy company.

Example: Reliance’s balance sheet might show massive assets (refineries, Jio’s network) but also hefty loans. Check if assets outweigh liabilities comfortably.

Trader’s LOL Moment: A balance sheet with too much debt is like a friend who borrows money but always “forgets” to pay back!

3. Income Statement: The Profit Scorecard

The income statement (or profit & loss statement) is like a company’s report card, showing how much money it made (or lost) over a period (usually a year).

- Key Parts:

- Revenue: Total sales or income. For Reliance, think Jio subscriptions + oil sales.

- Expenses: Costs like salaries, raw materials, or marketing.

- Net Profit: Revenue – Expenses. The bottom line—did the company make bank or tank?

- What to Look For:

- Growing revenue year-on-year = business is thriving.

- Controlled expenses = efficient management.

- Consistent or rising net profit = a winner.

Example: TCS’s income statement might show steady revenue from IT services and high profits due to low operational costs.

Quick Challenge: Find TCS’s latest income statement on Moneycontrol.com. What’s their net profit? Share it! #ProfitPro

4. Cash Flow Statement: The Money Flow Tracker

The cash flow statement shows how cash moves in and out of a company. It’s like tracking your pocket money—where’s it coming from, and where’s it going?

- Key Parts:

- Operating Cash Flow: Cash from core business (e.g., Reliance’s oil or Jio sales). Strong operating cash = healthy operations.

- Investing Cash Flow: Cash spent on assets (like factories) or earned from selling them.

- Financing Cash Flow: Cash from loans, dividends, or share sales.

- What to Look For:

- Positive operating cash flow = business generates cash organically.

- Balanced investing (spending on growth, not just hoarding cash).

- Manageable financing (not relying on endless loans).

Example: Reliance might show strong operating cash from Jio but heavy investing cash outflows for new projects like green energy.

LOL Moment: Negative cash flow is like your friend who’s always “broke” despite a fancy job—where’s the money going?!

5. Key Ratios: The Company’s Vital Signs

Financial ratios are like a company’s blood test results—they reveal its health in a snap. Here are three beginner-friendly ratios:

- Return on Equity (ROE):

- What Is It?: Measures how well a company uses shareholders’ money. ROE = Net Profit ÷ Equity.

- Why It Matters: Higher ROE (e.g., 15%+) means efficient profit-making. TCS often has high ROE due to strong IT margins.

- Watch Out: Too high ROE (e.g., >30%) might mean risky debt or accounting tricks.

- Debt-to-Equity Ratio:

- What Is It?: Compares debt to equity. D/E = Total Debt ÷ Equity.

- Why It Matters: Low D/E (e.g., <1) = less risky. Reliance’s D/E might be higher due to Jio’s loans but manageable if profits are strong.

- Watch Out: High D/E (e.g., >2) = debt overload.

- Earnings Per Share (EPS):

- What Is It?: Profit per share. EPS = Net Profit ÷ Number of Shares.

- Why It Matters: Growing EPS = more profits for shareholders. TCS’s EPS often grows steadily due to consistent earnings.

- Watch Out: Falling EPS = red flag for profitability.

LOL Moment: A bad ratio is like a Tinder bio with red flags—you swipe left and run!

6. Example: Analyzing Reliance Industries

Let’s put it all together with Reliance Industries, India’s mega-conglomerate (oil, telecom, retail, and more).

- Step 1: Balance Sheet:

- Check Reliance’s assets (refineries, Jio’s network) vs. liabilities (loans for expansion). On Screener.in, Reliance’s total assets might be ₹15 lakh crore, with liabilities around ₹5 lakh crore, leaving strong equity.

- Verdict: Solid asset base, but watch debt levels.

- Step 2: Income Statement:

- Revenue from Jio, retail, and oil might be ₹8 lakh crore annually, with net profit around ₹70,000 crore.

- Verdict: Growing revenue and profits = healthy business.

- Step 3: Cash Flow:

- Operating cash flow from Jio and retail is likely positive, but heavy investing in green energy might show outflows.

- Verdict: Strong operations, but big investments need monitoring.

- Step 4: Ratios:

- ROE: ~10-12% (decent for a conglomerate).

- D/E: ~0.8 (manageable but higher due to Jio loans).

- EPS: Growing steadily as Jio and retail scale.

- Verdict: Reliance is a strong long-term bet if you’re okay with moderate debt.

LOL Moment: Analyzing Reliance feels like judging a multi-course meal—oil, Jio, retail, all on one plate!

7. Getting Started: Tools & Platforms

No need to dig through dusty files—modern tools make analysis a breeze. Here’s how to start:

- Screener.in: Free platform to check balance sheets, income statements, cash flows, and ratios for Indian companies like Reliance or TCS.

- Moneycontrol.com: Offers financials, news, and ratios in a beginner-friendly format.

- Zerodha Varsity: Free lessons on fundamental analysis. Check their “Stock Investing” module.

- Tijori Finance: Great for visualizing cash flows and comparing companies.

- Company Websites: Reliance and TCS post annual reports on their investor pages.

How to Start:

- Pick a company (e.g., Reliance or TCS) on Screener.in.

- Check one financial statement (e.g., balance sheet) and one ratio (e.g., ROE).

- Compare with competitors (e.g., TCS vs. Infosys).

- Read news on Moneycontrol to understand market trends.

- Start small—invest only what you’re comfortable losing.

LOL Moment: Digging into financials feels like being a detective, but instead of a magnifying glass, you’re wielding a calculator!

8. Practical Tips for Novice Investors

- Start Simple: Focus on one statement (e.g., income statement) and one ratio (e.g., EPS) to avoid overwhelm.

- Compare Peers: Check TCS vs. Infosys or Reliance vs. Adani to spot the stronger player.

- Look Beyond Numbers: Read news about management, industry trends, or new projects (e.g., Reliance’s green energy push).

- Invest Long-Term: Fundamental analysis shines for 3-5 year bets, not day trading.

- Stay Patient: Analyzing takes time, like waiting for the perfect biryani to cook.

- Learn More: Zerodha Varsity and Moneycontrol’s blogs are goldmines for beginners.

9. Conclusion: