POWER OF PLEDGING

What is Pledging?

Pledging means using your securities as collateral to secure margin from your broker to buy / sell intraday stocks or trade in futures and options. Here no interest is charged on this margin. This margin is different than margin trading where securities are pledged as collateral to secure loan to buy financial assets like stocks where a pledgor has to pay interest on margin.

If you have invested in stocks, bonds, ETFs or mutual funds then you can use these investments as collateral to get interest free margin to trade in Futures and Options or for Intraday trading.

How to pledge your investments to get this margin?

I will use Zerodha to demonstrate the process.

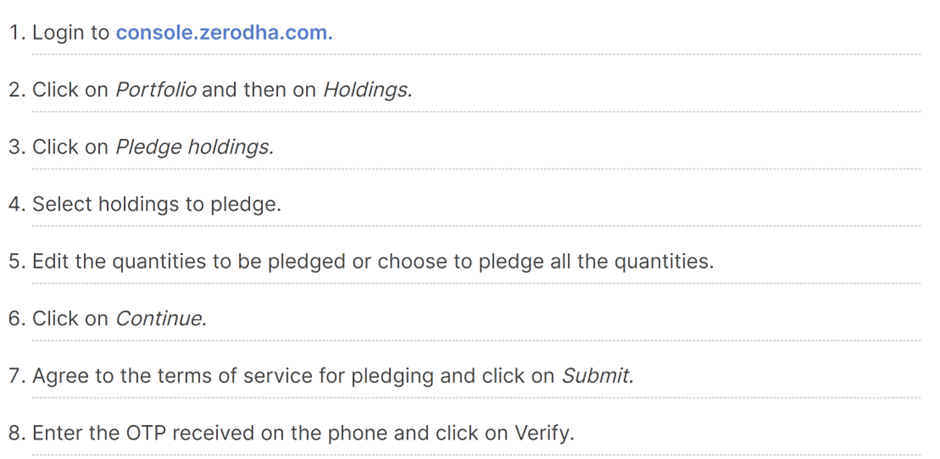

For Zerodha Kite – Web

Figure 1: Source Zerodha

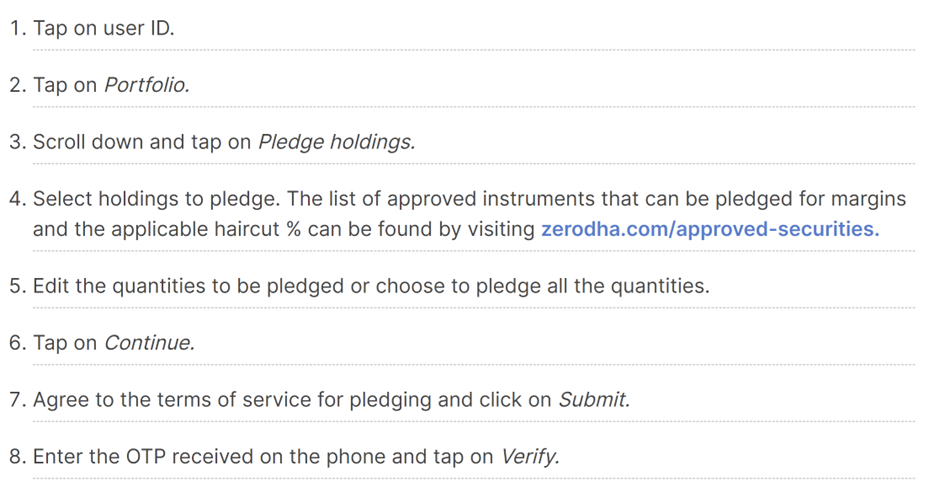

Figure 1: Source ZerodhaFor Zerodha Kite – App

Figure 2: Source Zerodha

Figure 2: Source ZerodhaSince you know what is pledging and how to pledge your securities to get the margin for trading. Now Let us understand the two components of margin and how to get 100% margin from collateral.

As per the regulations, 50% margin can come from non-cash component of collateral and remaining 50% must come from cash or cash equivalent.

Let us understand this,

There are two components of collateral

- Non-Cash Component and

- Cash or Cash equivalent Component.

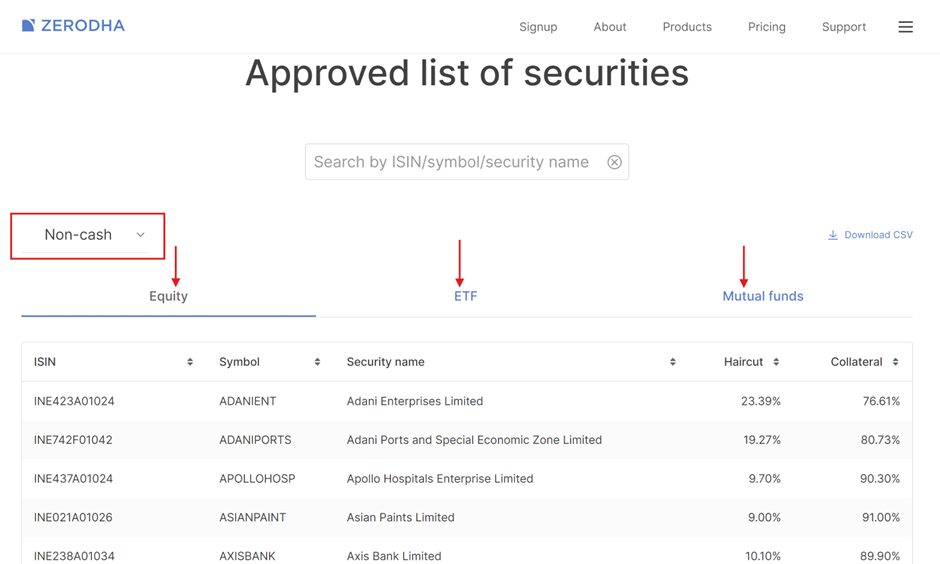

Zerodha gives a list of all the securities that can be pledged for margin and the applicable haircut percentage. Click here to get the list.

- Non-Cash Component

Figure 3 above gives a list of Equity, ETFs and Mutual Funds that can be pledged for Non-Cash component of collateral. As per the regulations, 50% of the margin may come as a collateral from these securities.

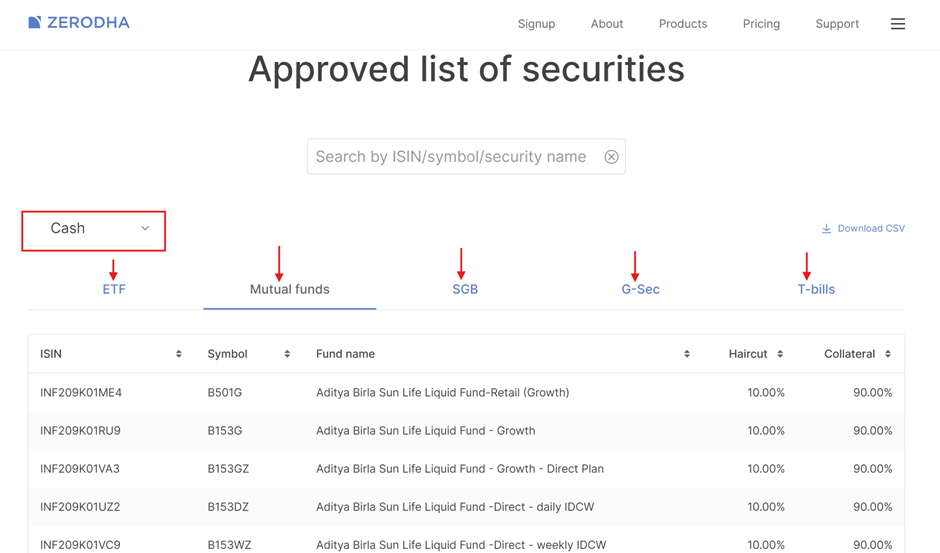

- Cash or Cash equivalent component

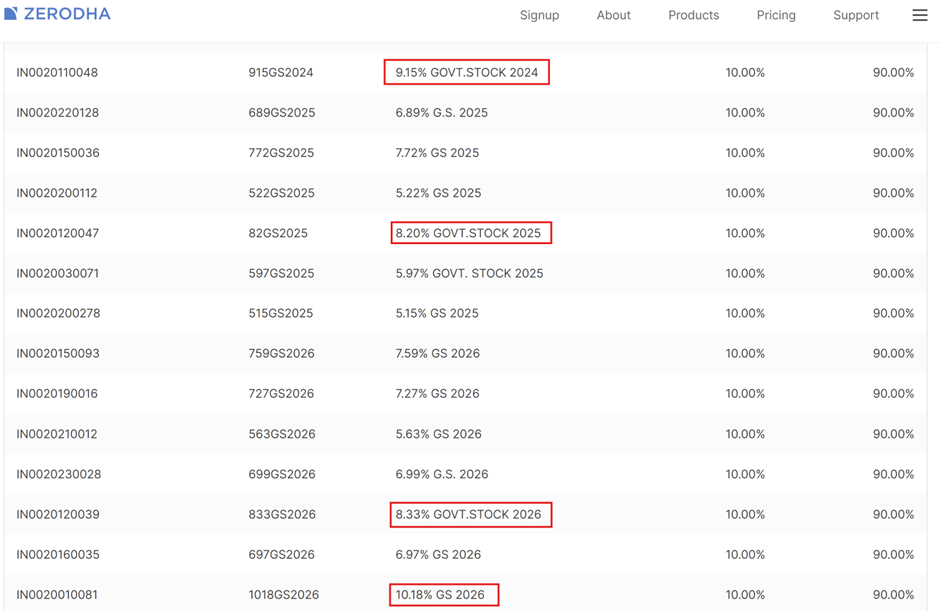

Figure 4 above gives a list of ETFs, Mutual Funds, SGBs, G-Secs and T-bills that can be pledged as Cash equivalent component of collateral. As per the regulations, atleast 50% of the margin should come as cash or as a collateral from these cash equivalent securities.

Now by pledging these cash equivalent securities and non-cash securities you can get 100% margin by pledging securities as collateral for trading.

However, for practical purpose, it is always advisable to have some percentage of your trading capital in the form of cash, which will act as a working capital to manage short term losses.

Now let us come to earning extra 8 to 10% risk-free returns over and above your trading income.

Since the chances of default by Government of India are extremely rare, all Government Securities and Treasury bills are considered as risk free assets. These G-secs and T-bills gives returns ranging from 8-10%. Below is the list of Government Securities which can be pledged as cash component of margin and this margin can be used for trading.

These risk-free returns which you get will be over and above your trading income.

Tips

- Commodity futures and options cannot be traded using collateral margins

- Collateral margins cannot be used until negative balances are cleared

- A delayed payment charge of 0.035% per day or 12.775% p.a is applicable on the shortfall in the cash margin requirement

- Securities can be pledged between 8 AM and 6 PM on trading days. However, there are no restrictions on unpledging.

- The cost of pledging is ₹30 + GST per request, per ISIN, irrespective of the quantity pledged. There are no charges for unpledging.

- The F&O segment must be activated to pledge holdings.

- Pledged stocks can be sold instantly on Zerodha Kite by simply placing a normal sell order.

- Click here to open a Zerodha account and start trading.